Date of Release:

September 28, 2022

The City Commission voted last night to LOWER Paducah's property tax rate from 27.1 to 26.5 cents per $100 of assessed value.

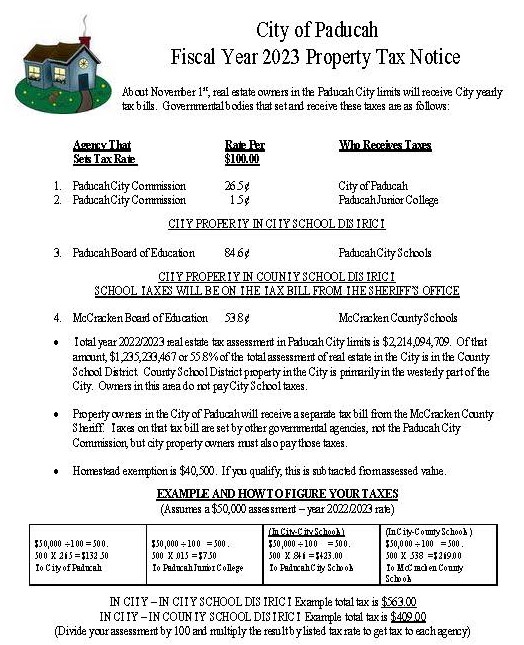

The graphic below shows how the real estate tax is calculated for property owners within the Paducah city limits. You need to know your property’s assessed value and your school district. Please note that the City government does NOT set the city or county school tax rates or assess a property's value. Property owners will receive a separate bill from the McCracken County Sheriff for County government and other agencies.

Property tax bills will be arriving around November 1. Learn more by visiting Property Tax.